Blog

September 4, 2025 • 3 min read

In the bustling world of small and medium-sized enterprises (SMEs), every single dollar and decision really counts. You know, just one misstep in budgeting or an overlooked cash flow issue can put everything on shaky ground. That’s why a growing number of SMEs are looking to AI to not only help with the grunt work of accounting but also lend a hand in making smarter choices moving forward—thanks to predictive analytics that help them anticipate challenges and plan better for what’s next.

What is Predictive Analytics?

Predictive analytics is all about using past and present data to make educated guesses about what might happen down the line. In the good old days, it was mostly the big players with deep pockets who could afford teams of number-crunchers and fancy forecasting models. But guess what? Now, with AI making an impact in accounting, SMEs can tap into this powerful tech without breaking the bank, all within their usual accounting software.

How AI Powers Better Planning in Accounting

Today’s AI-powered accounting tools are like having a financial assistant that never sleeps. They sweep up data from invoices, bank statements, payroll figures, and even outside economic hints. By leveraging machine learning and smart analytics, these tools take on the heavy lifting to:

- Spot trends in revenue, expenses, and seasonal changes that are just hanging out.

- Predict future cash flow based on invoices sent and bills waiting to be paid.

- Create flexible budgets that shift gears as real-life situations evolve.

- Give decision-makers a heads-up when financial hiccups (like running low on cash) might pop up.

Let’s explore this further with real-life stories:

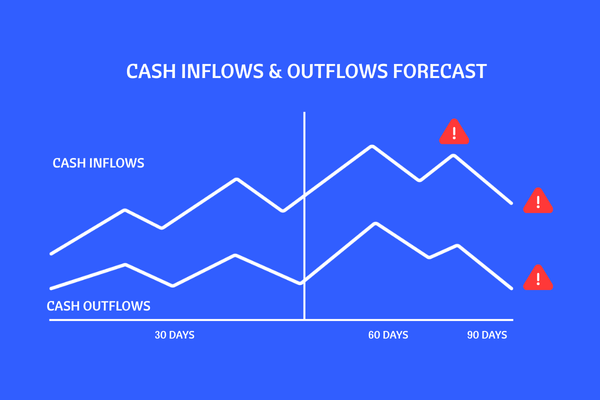

1. Cash Flow Forecasting: No More Surprises

In the world of SMEs, having cash on hand is like gold. Running out—even for a hot second—can mean missed chances or worse, going under. Thanks to AI in accounting, collecting money owed and keeping an eye on payments becomes a breeze. With predictive models crunching the numbers, businesses can see cash coming in and going out weeks or even months ahead.

Example:

Picture a creative agency in New York that jumped onto an AI accounting platform in 2025. Their cash flow was as unpredictable as the New York weather, and payroll was a monthly nail-biter. The AI cash flow forecasting feature gave the finance lead automatic 90-day forecasts that flagged low cash situations weeks beforehand. This foresight allowed them to negotiate payment schedules, tighten spending, or line up short-term credit early on, helping to dodge several budget crises.

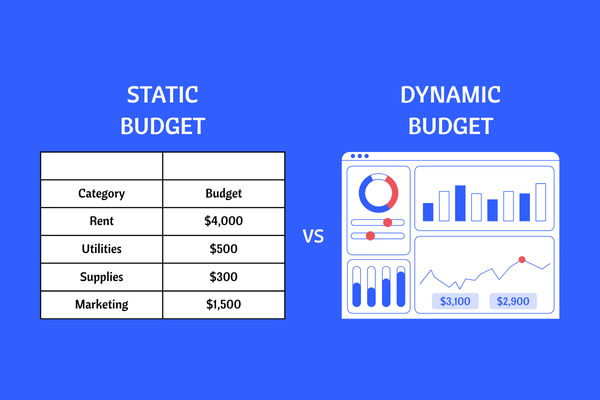

2. Dynamic Budget Planning: Smarter Resource Allocation

Old-school budgeting is a pain—set it and forget it tends to lead to chaos as things change around you. But AI in accounting takes that static budget and breathes life into it—so that funds adjust automatically when sales soar, costs spike, or new opportunities arise.

How does it work?

AI discerns patterns in historical spending, recognizes seasonal sales ups and downs, and pays attention to price shifts from vendors. It then tosses out suggestions for real-time budget tweaks—and for SMEs with tight margins, it’s a total game changer.

Example:

Take a retail SME in Chicago, for instance. They used AI-driven insights to discover that holiday promotions often led to unexpected inventory costs and missed income goals. The AI platform adjusted their budget targets midway through the quarter, balancing out marketing, inventory purchases, and staffing so they could make the most of opportunities as they popped up.

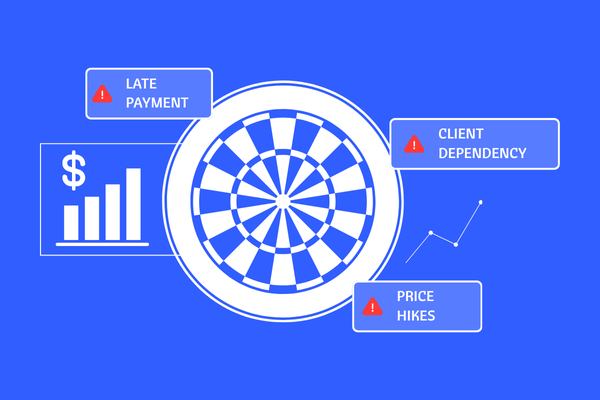

3. Identifying Financial Risks Before They Become Problems

A huge perk of using predictive analytics is that you get to dodge risks well in advance. AI tools are like your business’s early warning system, illuminated by data long before issues show up on usual financial statements. This could include:

- Customers dragging their feet on payments.

- Relying too heavily on a shrinking customer base.

- Sudden increases in vendor costs.

- Signals of a potential economic downturn.

By keeping an ongoing eye on the landscape around them, AI alerts managers to these red flags before they escalate—helping them tackle problems before they spiral out of control.

Example:

Imagine a SaaS start-up in California that brought AI insights onto their accounting dashboard. The system pointed out that one major client, contributing to a quarter of revenue, was consistently behind on their bills. Thanks to this early alert, the leadership team diversified their clients and renegotiated terms, evading what could have turned into a major cash crisis.

Why SMEs Can’t Ignore Predictive Analytics

- Better cash flow management: No more guessing games or panicking at the last minute looking for funds.

- Agile budgeting: Shift financial resources where they’re needed most, just when they’re needed.

- Increased risk awareness: Identify potential troubles before they escalate into crises.

- Faster, smarter decisions: Equip leaders with current insights instead of outdated spreadsheets.

For small and medium-sized businesses (SMEs) looking to get into AI in accounting with predictive analytics, it’s not just about staying relevant anymore. They’re actually jumping ahead of their rivals. By harnessing their data effectively, they can make bold decisions and strengthen their businesses, no matter what challenges come their way.

Looking at the way 2025 is going, predictive analytics has transformed from a luxury to a necessity for anyone looking to thrive in an unpredictable environment. With AI in accounting as their reliable companion, these businesses are well-equipped to navigate the future successfully.